The Top Reasons Why House Owners Pick to Secure an Equity Finance

For numerous house owners, picking to protect an equity car loan is a strategic financial decision that can use numerous benefits. The capacity to tap into the equity constructed in one's home can give a lifeline throughout times of economic need or serve as a device to accomplish specific goals. From consolidating debt to carrying out significant home remodellings, the factors driving people to select an equity loan are impactful and varied. Comprehending these motivations can shed light on the prudent economic planning that underpins such options.

Financial Obligation Debt Consolidation

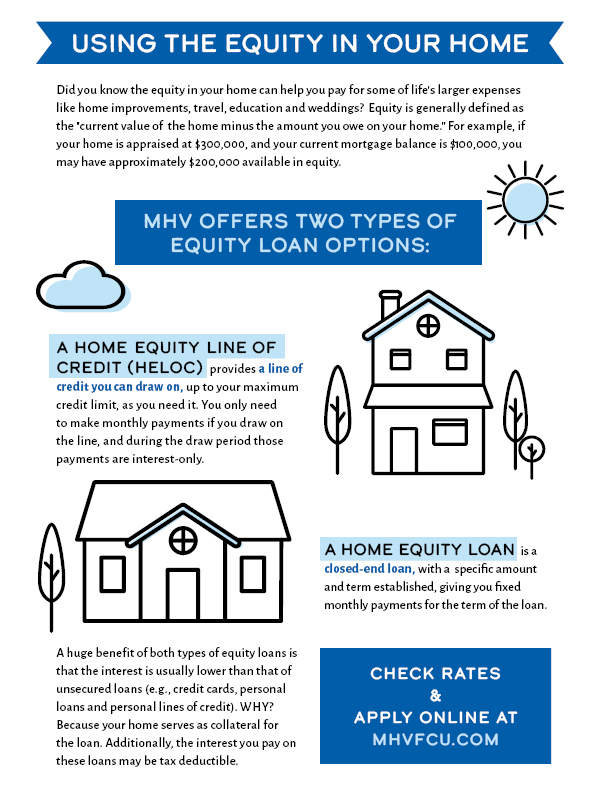

House owners typically decide for securing an equity car loan as a strategic financial move for debt loan consolidation. By leveraging the equity in their homes, individuals can access a lump amount of cash at a lower rates of interest compared to various other kinds of borrowing. This funding can after that be used to pay off high-interest financial debts, such as credit card equilibriums or personal fundings, enabling homeowners to improve their economic responsibilities into a single, more workable monthly settlement.

Financial obligation loan consolidation with an equity financing can offer numerous benefits to house owners. First of all, it streamlines the payment process by incorporating several debts right into one, lowering the danger of missed out on settlements and possible penalties. The lower rate of interest rate associated with equity car loans can result in considerable cost financial savings over time. Additionally, combining financial debt in this fashion can boost an individual's credit rating by lowering their general debt-to-income proportion.

Home Improvement Projects

Taking into consideration the boosted value and capability that can be accomplished via leveraging equity, lots of people opt to assign funds in the direction of numerous home renovation jobs - Alpine Credits Home Equity Loans. House owners often pick to protect an equity funding particularly for renovating their homes as a result of the considerable rois that such projects can bring. Whether it's upgrading obsolete attributes, broadening space, or boosting energy effectiveness, home enhancements can not only make living areas more comfy yet likewise enhance the total worth of the property

Usual home improvement jobs moneyed with equity fundings consist of cooking area remodels, restroom renovations, basement ending up, and landscape design upgrades. By leveraging equity for home enhancement projects, home owners can develop rooms that better fit their requirements and preferences while likewise making a sound monetary investment in their property.

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

Emergency Expenses

In unexpected scenarios where instant financial assistance is called for, safeguarding an equity financing can give house owners with a feasible service for covering emergency expenditures. When unforeseen events such as medical emergency situations, immediate home fixings, or abrupt task loss arise, having accessibility to funds with an equity funding can provide a safety web for house owners. Unlike other kinds of borrowing, equity lendings typically have reduced interest prices and longer payment terms, making them a cost-effective alternative for dealing with prompt monetary needs.

One of the key benefits of using an equity finance for emergency expenditures is the speed at which funds can be accessed - Alpine Credits Home Equity Loans. Homeowners can quickly touch into the equity accumulated in their property, permitting them to deal with pressing monetary issues right away. Furthermore, the flexibility of equity loans allows property owners to borrow only what they need, staying clear of the problem of taking on too much financial obligation

Education And Learning Funding

Amid the pursuit of college, safeguarding an equity lending can act as a strategic funds for home owners. Education and learning funding is a considerable issue for many family members, and leveraging the equity in their homes can give a means to gain access to required funds. Equity car loans frequently offer reduced rate of interest compared to other forms of borrowing, making them an eye-catching choice for financing education and learning costs.

By taking advantage of the equity developed up in their homes, property owners can access significant quantities of cash to cover tuition fees, books, holiday accommodation, and other relevant expenses. Home Equity Loans. This can be specifically helpful for parents aiming to support their youngsters with college or individuals looking for to further their very own education. In addition, the rate of interest paid on equity lendings might be tax-deductible, providing possible financial benefits for borrowers

Eventually, utilizing an equity funding for education funding can aid individuals invest in their future earning possibility and profession improvement while effectively managing their economic obligations.

Investment Opportunities

Verdict

In final thought, home owners choose to protect an equity loan for different factors such as debt consolidation, home renovation jobs, emergency expenditures, education funding, and investment possibilities. These car loans supply a means for homeowners to gain access to funds for vital economic needs and goals. By leveraging the equity in their homes, house owners can capitalize on reduced rate of interest and flexible payment terms to accomplish their monetary purposes.

Comments on “Home Equity Loan Perks: Why It's a Smart Financial Relocate”